(PONARS Eurasia Commentary) It is clear by now that several East Asian responses to the coronavirus scourge have been extremely efficient, especially in China and South Korea. Now, countries elsewhere hit by the virus have been incorporating East Asian response toolkits, with many strategies slowly yielding results. However, there is a new danger today: economic recession caused by the pandemic—quite possibly the deepest recession of the postwar period. On this front as well, Asian experiences can be valuable, particularly regarding paradigms of social solidarity and state intervention.

Actions in Asia

Articles in the local media have been full of praise for Asian values, such as the prioritization of societal interests over those of the individual, which has helped ensure quick and efficient actions to fight the spread of the disease. In Hong Kong, Singapore, Taiwan, and Vietnam, the number of infected people remained relatively low despite their citizens’ intensive contact with people from mainland China.

The phrase that John F. Kennedy used in the 1960s, “ask not what your country can do for you—ask what you can do for your country,” may have been novel in the United States at the time, but it is a commonplace truth in China and East Asia. “We never imagined there could be a different philosophy,” my Chinese friend once said to me.

China took harsh measures that surprised many. Hundreds of millions of people were confined to their homes without much delay. Stadiums were converted to hospitals in days and new hospitals were built in less than two weeks. The authorities enacted military-style blockades of roads and even of whole cities. They prohibited people from leaving their homes and made mask wearing obligatory in public. Residential management committees organized the delivery of goods to residents and neighborhood watch groups ensured that residents complied with regulations. In Hubei province (Wuhan is the capital), GDP fell by nearly 40 percent (!) in the first quarter, compared to GDP in China as a whole that fell by nearly 7 percent.

In South Korea, 250,000 people were tested by mid-March, 100 times more on a per capita basis than in the United States, where, by then, only 15,000 were tested.

Deeper than the Great Recession?

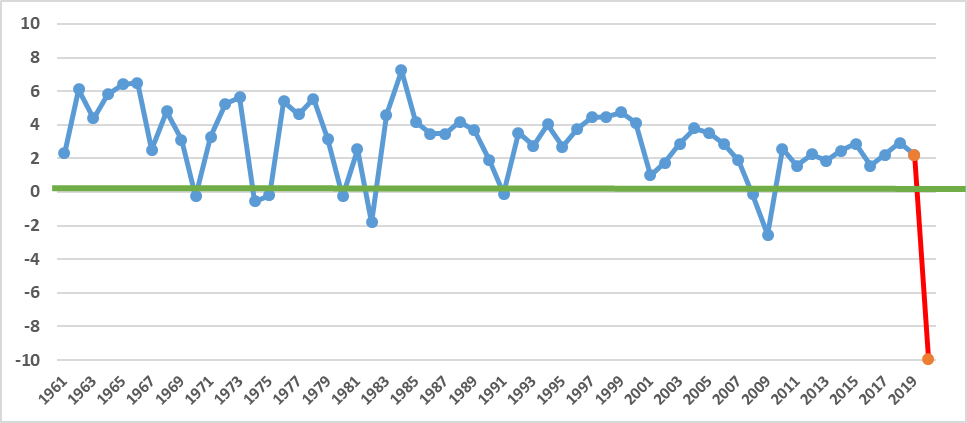

Looking at past indicators for comparative purposes, postwar economic recessions were very mild. Annual GDP in the United States has not fallen considerably—no more than 1 to 2 percent (Figure 1). Even in the last recession of 2008-09, the reduction of U.S. GDP totaled only 0.1 percent in 2008 and 2.5 percent in 2009 (Figure 1). On the contrary, during the Great Depression of the 1930s, U.S. GDP fell for four years in a row and in 1933 it was about 30 percent lower than it was in 1929. It recovered to the pre-recession 1929 level only in 1936 but then fell again in 1937-38.

Figure 1. U.S. GDP Annual Growth Rates (%)

Note: The red line in Figure 1 shows a possible reduction in 2020 (2019 is 2.2 percent). Source: World Bank’s World Development Indicators database.

If in the current global upcoming coronavirus recession the reduction of output in major Western countries will total about 10 percent (see the red line above), then this will be the deepest recession of the postwar period. In April 2020, this was the estimate of many forecasters.

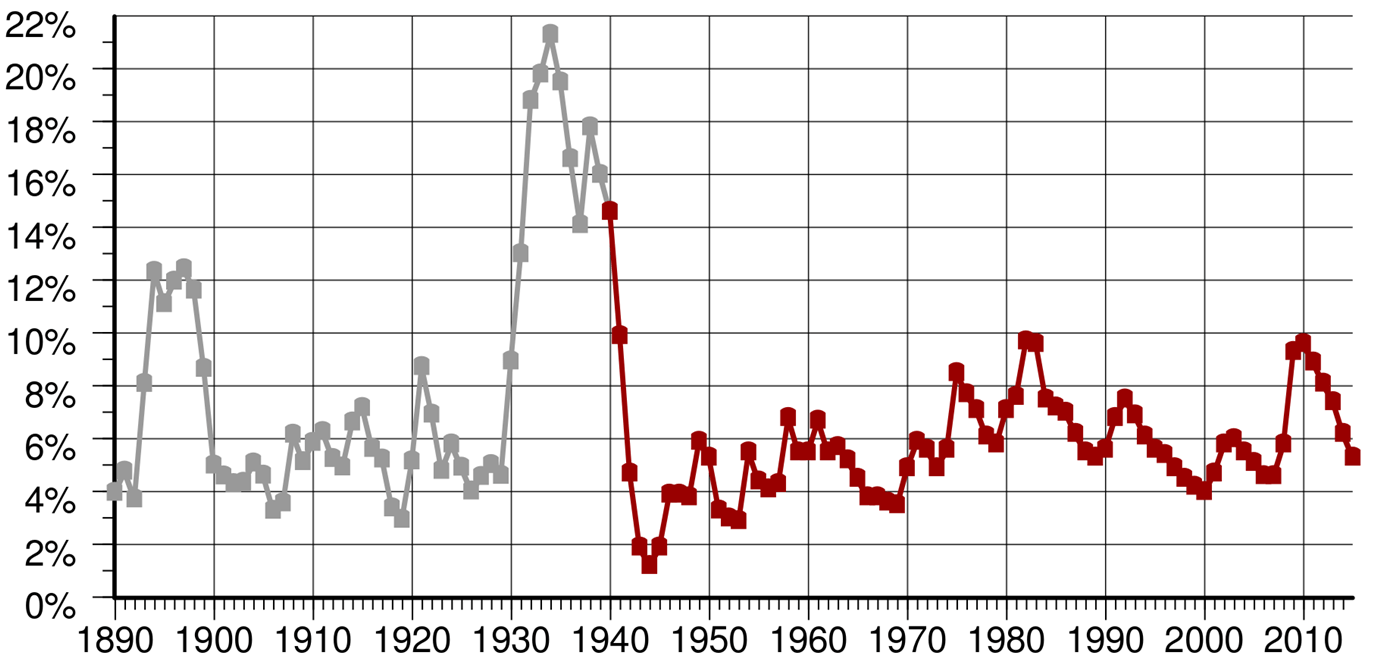

Further, when looking at the unemployment rate, it never exceeded 10 percent of the labor force in the postwar period, whereas at the end of the Great Depression, it exceeded 20 percent of the labor force (Figure 2).

Figure 2. United States Unemployment Rate (1890-2015)

Source: Unemployment in the United States (Wikipedia).

Shocks, Bottlenecks, and Structural Recessions

Economists distinguish between demand-driven and supply-side recession. The former is due to the shocks of demand—for instance if households decide to postpone purchases of consumer durables for whatever reason. The government can step, in this case, to stimulate effective demand through expansionary fiscal and monetary policy (the standard recommendation of Keynesian stabilization policy).

A supply-side recession is usually associated with increases in the costs of production. Examples could be wage increases, price increases of imported materials, unfortunate events such as pandemics, epidemics, earthquakes, and wars. A particular case of supply-side recession is a structural recession caused by the need to reallocate resources, labor, and capital from one industry/region to another.

Structural shifts happen all the time, such as when the industry producing music records transitioned to tapes, CDs, DVDs, iPods, and eventually to smartphones. If they are gradual and small scale, they do not cause recessions. But when a necessity emerges for a sudden large scale structural shift, a recession can occur, and time and effort are needed to reallocate resources from swiftly vanishing to swiftly emerging industries.

Recessions in Western countries associated with oil price peaks in 1973, 1979, and 2007 are examples of poorly managed structural shifts. In a market economy, the adjustment, in this case, occurs through an increase in unemployment. Industries that become unprofitable due to increased costs, lay off workers, thus, growing unemployment contributes to a fall in wages, and only later cheap labor costs can make it profitable to expand production in other industries. Without government assistance in retraining laid-off workers and providing stimuli for new investment, shifts may be painful, lengthy, and costly.

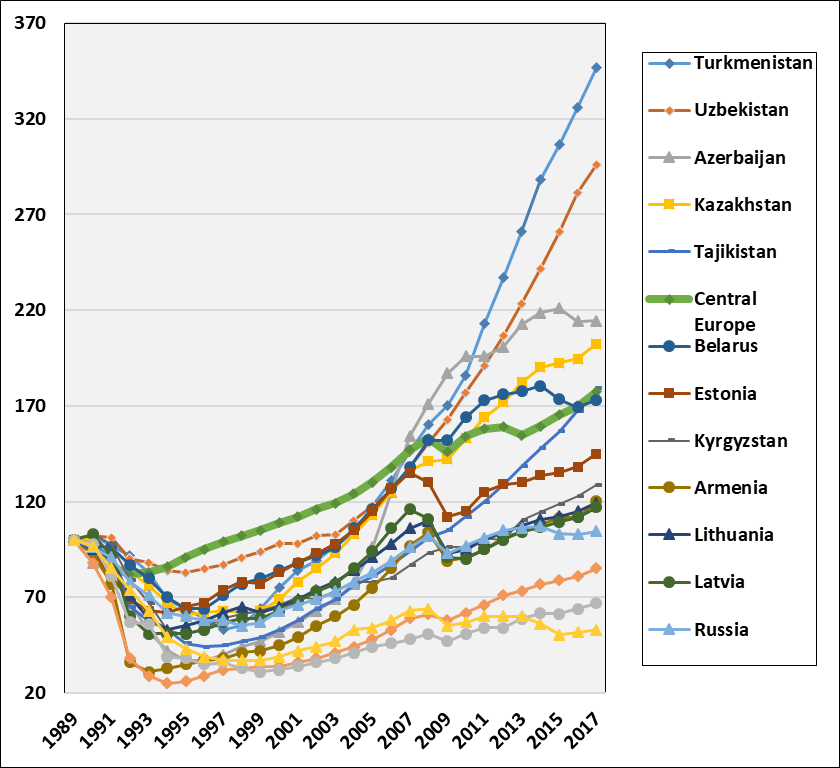

The “transformational recessions” that occurred in post-communist economies in the 1990s are examples of even worse management of structural shifts (Figure 3). These involved the decline of agriculture and industry and the rise of services (trade and finance) and resource industries. In many of these countries, the reduction of output during this transition was deeper than what happened in the Great Depression of the 1930s.

Figure 3. GDP Change in FSU Economies (1989 = 100%)

Source: EBRD Transition Report

How to Deal with a Structural Recession—Looking at Asia

In the case of the coronavirus pandemic, it could be overcome, in theory, by expansionary fiscal and monetary policy at the price of higher inflation. But the demand stimuli that are enacted simultaneously with the supply prohibitions for many businesses can result only in price increases. The quicker and more efficient solution is the elimination of “bottlenecks,” or the supply constraints, and by assisting and carrying out mandatory reallocations of labor and capital. This could transpire, say, if the facilities and workers affected by epidemic-related prohibitions (travel, tourism, office work, retail, sports, restaurants/food, entertainment, schools, universities, etc.) were to switch to working in public health, production of medical supplies, providing sanitation, care, and emergency services, and other public-order activities.

Quite a few successful examples of managing structural shifts can be found in East Asia where collective interests are a high priority and governments are not afraid to resort to market intervention and direct investment financing in times of crisis.

In China, the production of protective masks increased from 15 million a day in early February to over 100 million a day by the end of the same month! Over 3,000 enterprises that previously had nothing to do with the supply of healthcare products began producing masks, protective suits, sanitizers, and other hygiene goods. Several major companies began to make masks at their enterprises such as China Petroleum and Chemical Corporation, China National Machinery Industry Corporation, and the major auto manufacturers Shanghai GM Wuling, Guangzhou Automobile Group, and BYD.

The South Korean Ministry of Food and Drug Safety gave emergency approval to the company Seegene to mass produce a coronavirus test kit that it had developed in three weeks. All of its 395 employees dropped all other work and focused on making the test kits, with molecular biologists and senior scientists working the assembly line.

The Vietnamese company Vingroup said it can convert its automobile and smartphone factories in 3 months to produce 55,000 medical ventilators per month. The total stock of ventilators in the United States at the time of writing is estimated at 62,000 new and 100,000 old. The UK had about 21,000 ventilators in March.

Western countries have successful examples of conversion as well, for instance in times of war, when non-defense industries have been converted to produce defense items. This usually happened with state assistance, which eased and speeded up the transition. Before and during World War II, governments normally increased taxes and borrowings and used the proceeds to purchase weapons. In the United States, the increase in defense procurements after the recession of 1937-38 caused a boom: economic growth went from negative values in 1938 to 17-20 percent growth annually in 1941-43. Never before and never after has the American economy grown that fast.

Even better results have been exhibited by centrally planned economies, which have clear advantages over market economies in mobilizing domestic savings and converting them into investment and in promoting structural shifts quickly and with full employment.

In the 1930s-40s (a range of complexities aside), the USSR transferred huge resources from agriculture to industry, from light to heavy industry, and from non-defense to defense industries. In 1940, Germany produced two times more steel and more defense output than the Soviet Union, but already by 1943, the USSR had surpassed Germany in the production of tanks, aircraft, and artillery guns. Such structural shifts were the most crucial reasons that changed the course of the war.

When Time is of the Essence

If coronavirus contamination continues to spread quickly, the ability of countries to move resources rapidly from non-health to health-related industries would be a crucial factor not only for fighting the epidemic but also in fighting recession. An extreme example of forced reallocation of resources is the labor armies created by Soviet Russia in 1920 and employed between battles (see the poster below from that time).

“One Must Work, the Rifle Is Right Here”

A Russian avant-garde poster (1920-21) by Vladimir Lebedev. Soviet Russia created labor armies to restore the ruined economy between battles as the Civil War came to a close.

Such labor armies are hardly possible today, but betting only on market forces to ensure equilibrium is a dangerous approach. For the market mechanism to work, an increase in government orders for ventilators should produce an increase in prices that is large enough to cover the costs of conversion and to ensure higher profitability for the companies to compensate for the risk—only then one can expect that enterprises will introduce second and third shifts and make the investment to expand the profile capacity and convert non-profile capacities. The faster and more efficient alternative, however, would be to enact legislation, such as the U.S. Defense Production Act, that immediately forces private enterprises to switch to producing needed equipment, no matter what the prices and costs are.

Our capacity to cope with the coming recession depends, to a large extent, on how governments will assist markets in carrying out structural shifts. As the world economy enters into a global recession this year, policymakers may be prudent to borrow social-solidarity and state-interventionist approaches from the constructive Asian cases of the past and present.

A shorter and earlier version of this essay was published by the Dialogue of Civilizations in March 2020.